The first borrower-focused NFT lending platform

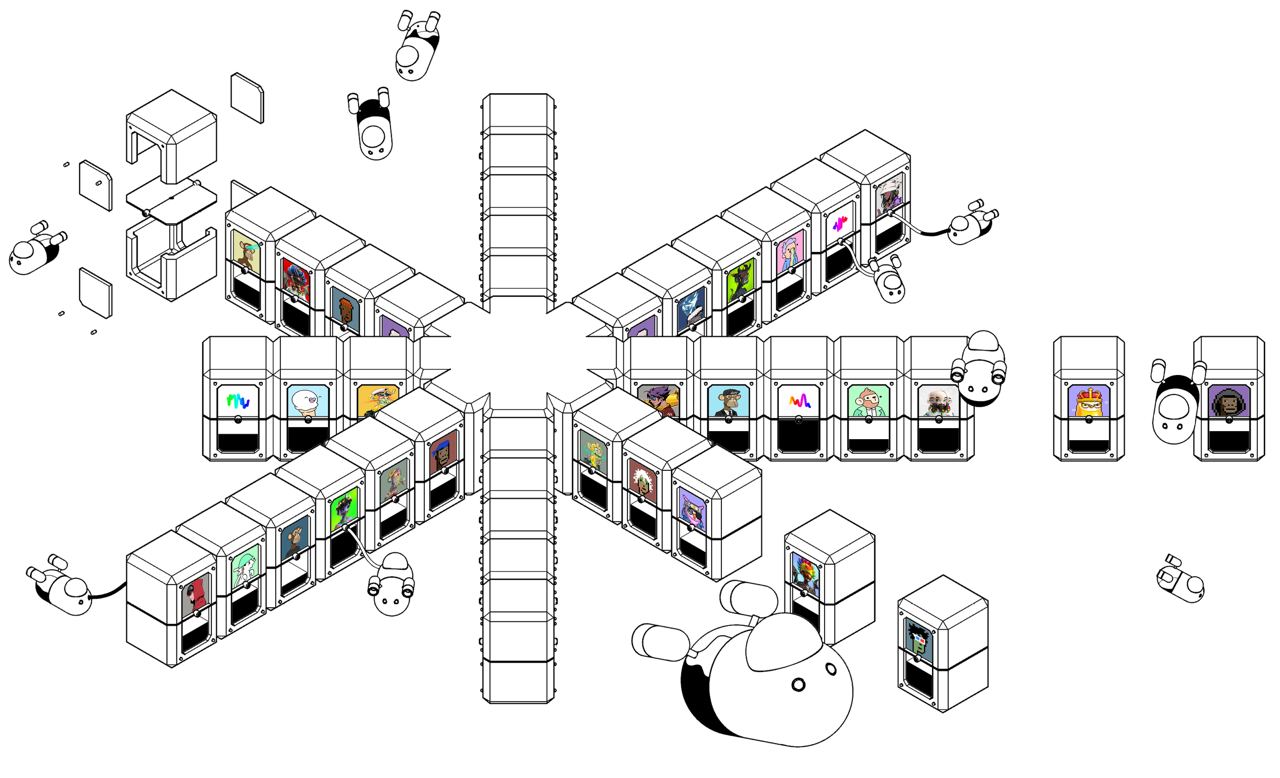

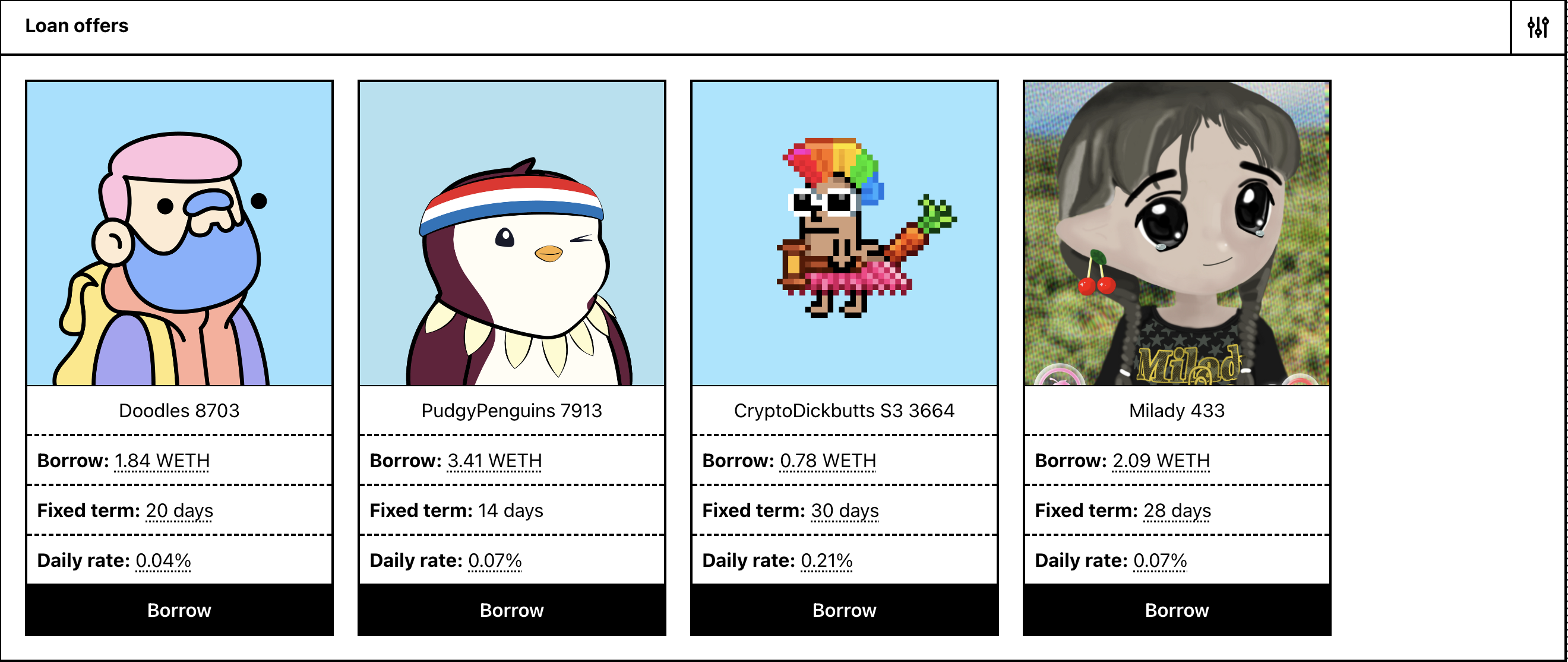

TLDR: New NFT lending platforms are emerging, of which, Astaria is the only one that focuses on the borrower's needs. With guaranteed loan and liquidation terms, competitive rates, and a top-tier user interface, securing an NFT loan through Astaria brings unparalleled peace of mind.Collection of loan offers ready to go.

"The age of the farmer is coming to an end, the age of the borrower is here" - Anon 2023

Introduction

By putting the needs and interests of borrowers first, Astaria has redefined the lending landscape, revolutionizing the way individuals can leverage their NFT holdings. In this, article, we'll explore why Astaria is the most borrower-centric NFT lending platform and compare its features to the competition.

Loan Certainty

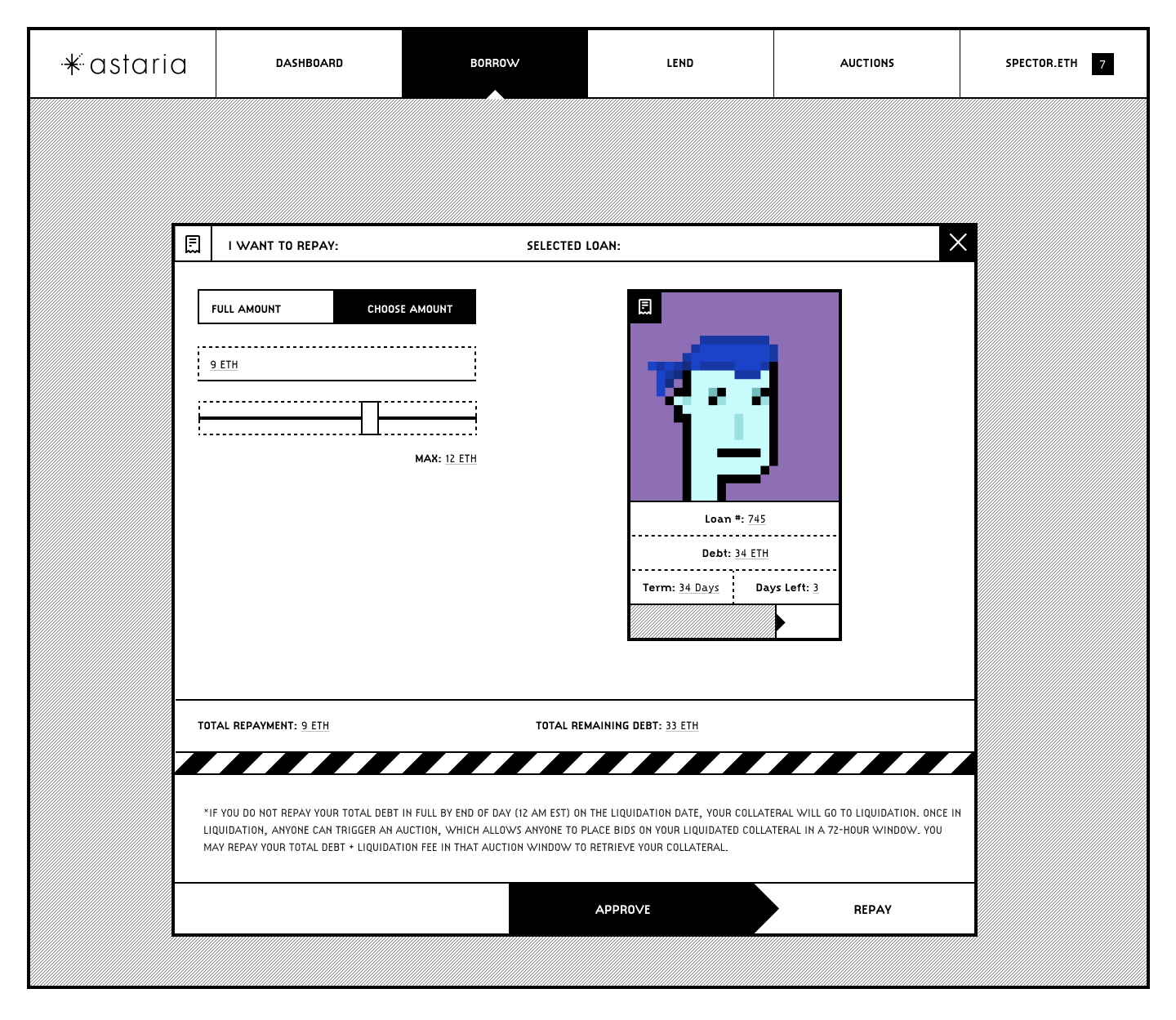

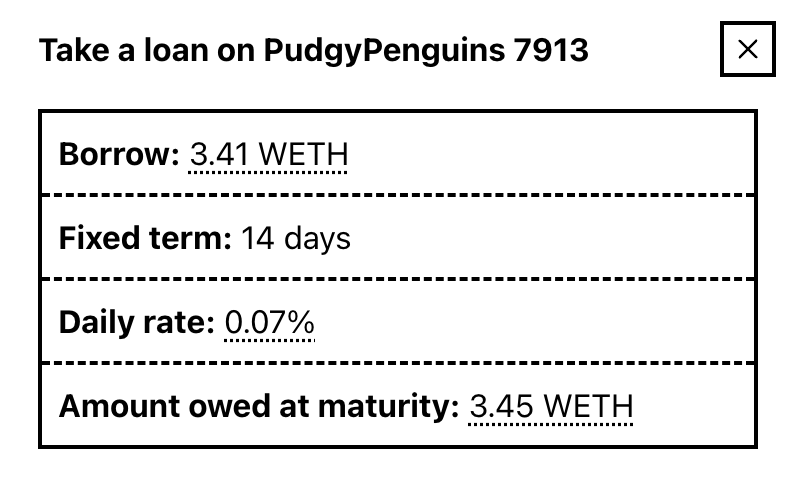

Astaria acknowledges that borrowers have the need for more surety with their open loans. With fixed-length and fixed interest rates, borrowers can rest assured, knowing their loan terms are solidly established from the outset. Astaria has also opted to eliminate forced liquidations, significantly reducing the anxiety associated with maintaining loans over extended periods. Users now only need to focus on paying down their debt before the loan's maturity and can comfortably disable their floor price alerts.

Competitive Terms

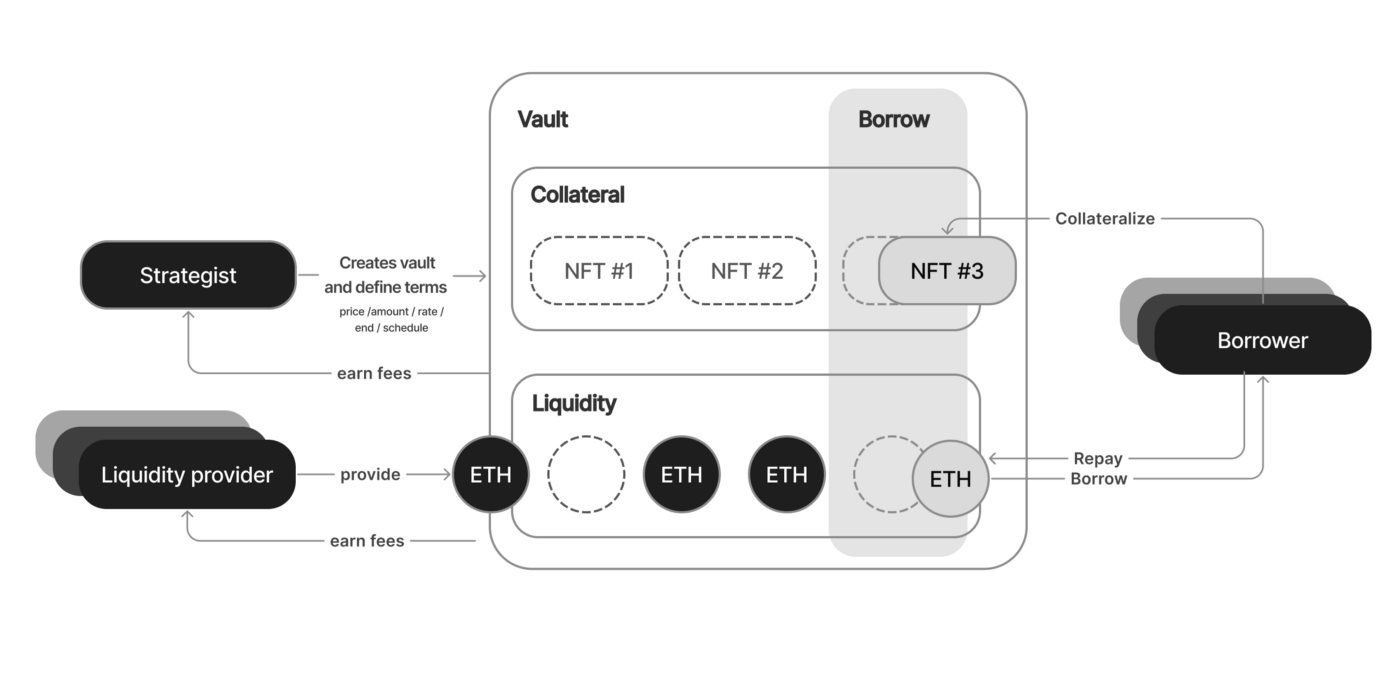

A borrower-centric lending platform should prioritize fair and transparent terms. Astaria shines in this aspect, offering highly competitive interest rates and clearly defined loan terms. Ensuring that borrowers have access to the most reputable appraisers in the space, all vying for the best terms, sets our platform apart. While bespoke pricing per piece does occur on the peer-to-peer lending side, we've highlighted the drawbacks of this model's scalability in a previous article. We propose a solution that amalgamates the benefits of peer-to-peer and peer-to-pool, to escalate our product offering beyond either method.

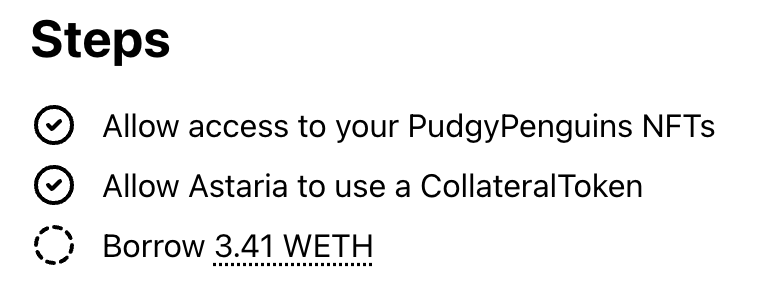

Streamlined Borrowing Process

Astaria provides a streamlined, efficient, and user-friendly borrowing process. The intuitive interface stands head and shoulders above the rest, reinforcing Astaria's emphasis on user experience. Borrowers can secure funds on the best terms faster than on any other platform, without any compromise.

Responsive Customer Support

It often baffles how our industry can attract new entrants without offering support to users who may be stuck. Not at Astaria. If you use Astaria and are having trouble anywhere along the way, reach out to us on Discord, create a ticket and the team will be sure to help you. Our team is active on Discord and eager to help users.

Follow us

We are working on a new set of promotion terms. Stay in touch to get the latest.