What is Astaria?

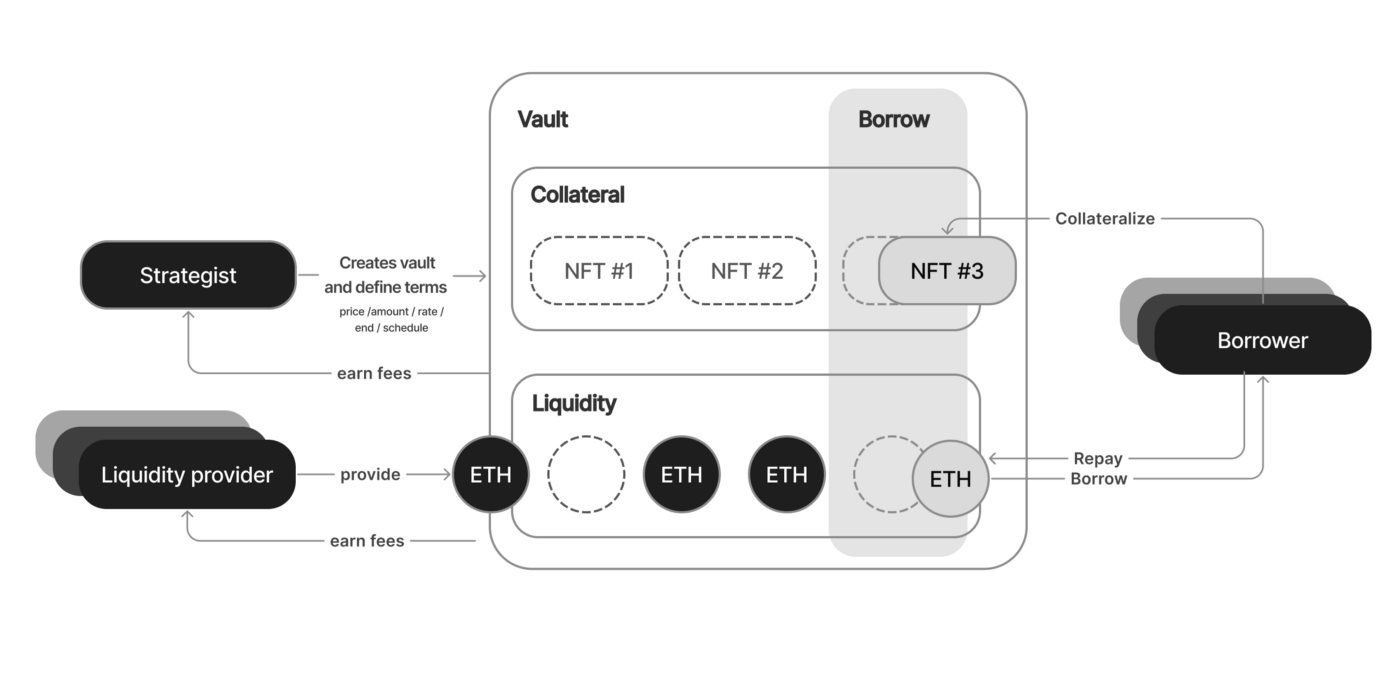

Astaria is an on-chain NFT lending platform that aims to provide a seamless experience for the native DeFi user. The Astaria protocol allows Strategists to publish loan terms through Vaults, which can accept capital from liquidity providers to be lent to borrowers. Competition between Strategists ensures that borrowers have access to competitive market rates and terms.

The Astaria protocol uses the three-actor model to provide instant liquidity to borrowers and provide competitive yields to liquidity providers. The model is built around three classes of users:

Strategists deploy vaults with a list of loan terms matched to supported NFTs. For example, one strategist may allow a 10 ETH loan with a 10% interest rate to be taken out against a specific NFT for one month. These terms are continuously updated as markets fluctuate. Any strategist may provide their own capital to fund these loans through their own

PrivateVaults, and whitelisted strategists can deployPublicVaultsthat accept funds from other liquidity providers. (PublicVaultwhitelists are only enforced at the UI level.).Borrowers take out loans against NFTs according to loan terms provided by Strategists.

Liquidity Providers earn yield on funds provided to

PublicVaults.

Instant liquidity

No need to go through a time-consuming bid-and-ask negotiation process to borrow against your NFT. Instead, instantly choose between any (or multiple) loan terms for your NFTs offered by our expert Strategists.

No forced liquidations

As a borrower, you may only be liquidated if your loan expires with outstanding debt. With no concept of floor prices in Astaria, forced liquidations on price changes are a thing of the past.